In last week’s article, we discussed HAI’s findings on global AI R+D and AI capabilities trends. This week, we’ll be focusing on the “supply and demand” equation. This indicates a significant decline in global investment in AI and a plateau in enterprise adoption of AI.

Investing in AI

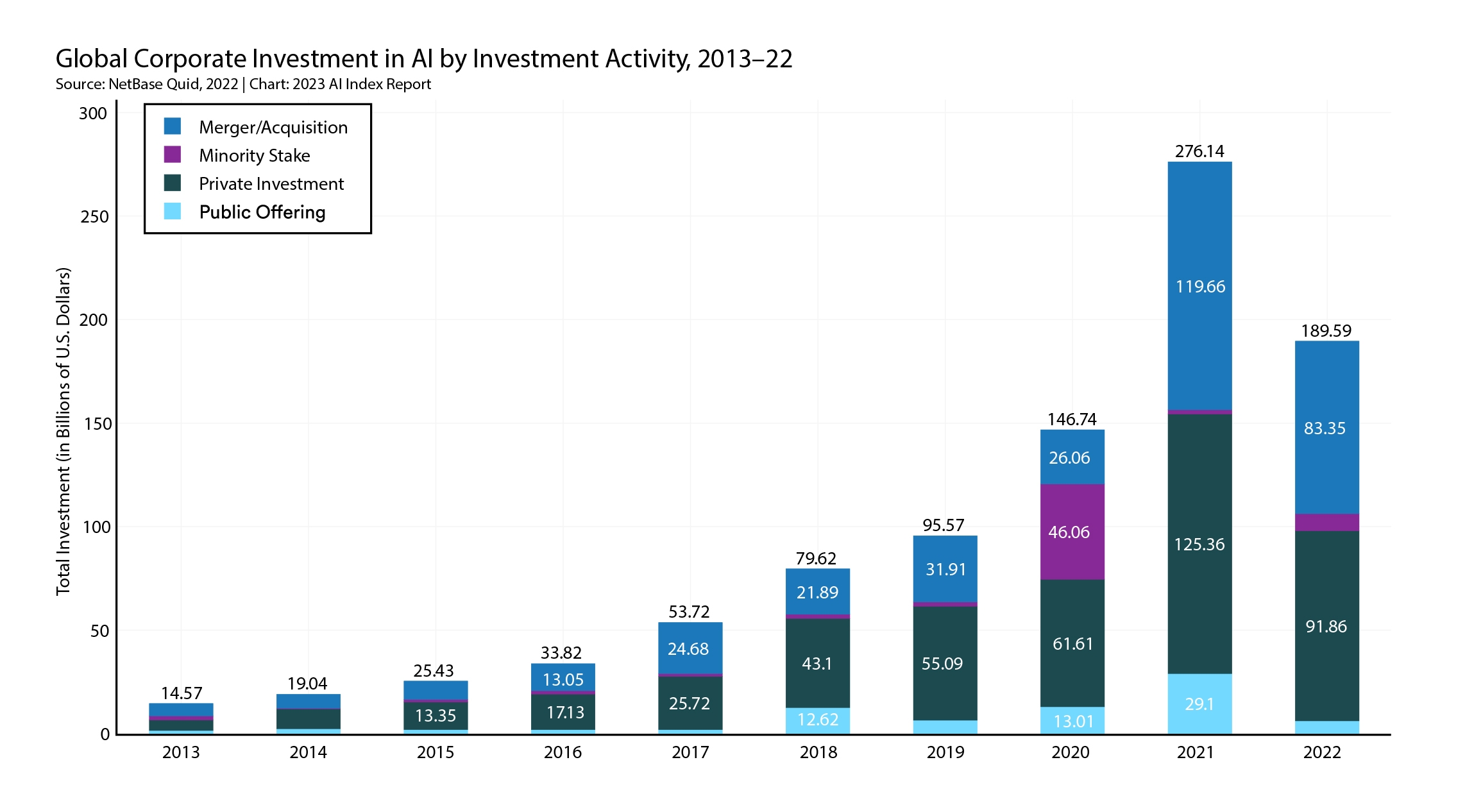

HAI reports that for the first time since 2013, global corporate investment in AI has declined year-over-year, falling by a third in 2022 from 2021. Increased investment through strategic minority stakes in AI companies. Chinese companies dominated IPOs.

The decline in total private investment in AI is reflected in the number of individual AI companies funded in 2022 compared to 2021 and the size of deals.

- There were 3,538 AI-related private investment “events”, down 12%.

- The number of newly funded AI startups dropped from 1,669 to 1,392.

- The number of deals below $50 million is down only 10%, while the number of deals in the $100-500 million range is down 40%.

Not surprisingly, the US accounts for most of the world’s private AI investment, 3.5 times more than China, the next highest country. However, both countries have experienced a steeper decline in private equity investment than the global average, with the United States down her 35.5% and China down her 41.3%.

While Australia is part of a long tail of much smaller private investment in AI, it is part of much larger economies such as Japan and countries commonly regarded as AI ‘star performers’ such as Finland. Better than both.

Australian private equity investment in AI may also be growing rapidly. Nearly half of Australia’s cumulative private equity investments since 2013 will occur in his 2022, with Australia moving up the ranks ahead of Switzerland, Japan and Singapore.

As has been the case in recent years, medicine and healthcare will be the main areas of focus for AI investment in 2022. Data management, processing and cloud. Fintech; Cybersecurity; and Retail. However, even considering the decline in private AI investment in all sectors, there was a shift to the ‘middle rank’ due to strong growth in HR tech, drones, AdTech and legal tech.

There are also differences in AI focus areas in different countries. The US is obsessed with drones, investing 53 times more than China in 2022. Conversely, China invested 1.75 times more in AI semiconductors than the US in 2022, probably reflecting the geopolitics of export bans. The US has invested 11 times more in AI legal technology than Europe, reflecting its lawyer-centric culture.

Adoption of AI

Based on a McKinsey survey of the corporate sector, HAI concluded that corporate adoption of AI is leveling off. By 2022, about 50% of companies report that he has adopted AI in at least one business unit. This is down slightly from his 2021, but still up from his 20% who reported using AI in 2017.

The number of AI apps deployed by individual companies has doubled on average from 1.9 to 3.8 since 2017. This suggests that as companies become more comfortable with AI, they will continue to push for more AI adoption. However, the average number of AI apps per business will also plateau in 2022.

Looking at companies using AI (formally), the most common AI enterprise uses in 2022 were service optimization, building new AI products with AI, and customer management. However, there has been a relative shift in the focus of companies’ use of AI from the “front office” (such as customer relationship and marketing) to the “back office” (risk management, strategy, financing, etc.).

The most embedded AI technologies across all industries were robotic process automation (39%), computer vision (34%), natural language text understanding (33%), and virtual agents (33%). Robotic automation usage levels were much higher (nearly 50%) in telecommunications, finance, legal, and professional services firms.

Contrary to the general trend that enterprise adoption of AI has plateaued, AI-powered industrial robots are picking up momentum, growing 31.3% in 2021 compared to 2020. Installed the most industrial robots in 2021 will be 268,200, 5.7 times more than Japan (47,200) and 7.7 times more than the US (35,000). In 2013, China accounted for her 20.8% of the world’s industrial robots, while in 2021 she will account for 51.8%. By contrast, Singapore, although with a much smaller economy, has lost more than a third of his AI industrial robots, reflecting its commitment to moving towards a professional services economy.

There have also been small but accelerating changes in the types of robots deployed in the commercial environment. So-called traditional robots are designed to work without humans, completely replacing them, while collaborative robots are designed to work with humans (perhaps still at a high level of proficiency). (replaces some workers with low wages). In 2017, only 2.8% of all newly installed industrial robots were collaborative, but in 2021 he increased to 7.5%.

What is behind the flattening of enterprise adoption of AI?

An overwhelming majority of business leaders recognize AI as critical to the future of their business. 94% say AI is not important, compared to only 1%. And while 82% of business leaders “strongly agree/agree” that AI will improve performance and job satisfaction, only 2% “strongly disagree/disagree”. was.

So where are the obstacles?

When asked what the main barriers to adopting AI were, most said difficulty proving AI’s business value (37%), followed by lack of executive commitment (34%), and lack of appropriate They cited their choice of AI technology (33%). Even when companies were experimenting with AI, proving a business case (40%) was a major challenge in convincing companies to expand their use of AI. Other challenges to moving beyond the “AI footing” stage included AI risks (50%), obtaining the right training data (44%), and implementation issues (42%). was I thought at first.

However, once companies have overcome these hurdles and introduced AI into their mainstream business, they have reportedly realized significant cost savings and increased revenue.

Utilization of invisible AI

But when we look away from this data on the use of AI by businesses, the story of AI adoption stagnating seems to defy all the hype around AI. One possible explanation is that given the ease of access to new generative models of AI, boards and executives may not be fully aware of the extent of AI’s use by individual employees. there is. How many performance reviews will be “polished” by chatGPT this year?

It may sound harmless, but performance reviews contain highly sensitive information as employees measure their performance against sales targets, corporate development targets, or changes in their positioning relative to their competitors. may be included. Similar information gleaned from employee performance reviews of other companies across the economy.

Professor Rob Nicholls described a recent case in which Samsung engineers used chatGPT to check coding and improve meeting notes.

“The problem is that ChatGPT can include material it used as a prompt to “train” its algorithm and improve its answers in the future. This is exactly what happened to a Samsung developer who used ChatGPT to improve his code and record meeting minutes. Materials once considered some of the most sensitive by Samsung are now available to non-Samsung developers, simply because a Samsung engineer used his ChatGPT to reduce development time. rice field. ”