If you've been looking at Reservation Holdings (BKNG) recently, you're not alone. The company has been in the spotlight, spurring the buzz about its trustworthy revenue track record and news, as it actively investigates AI technology partnerships with key players such as Google and Microsoft. These latest updates show that investors are paying special attention and that management aims to maintain financial discipline and pursue new paths for growth. When a company repeatedly outperforms its revenue and profit forecasts, it is difficult to not question what the market is when pairing its future thinking technical strategies with their consistency.

This new optimism has flowed into Reservation Holdings stocks, which have risen 34% over the past year and have risen 11% since the start of the year. The company's momentum appears to be built, even if it's been a little soaking for the past month. Investors are also digesting news about executive changes and strategic moves across the business, but that is actually stable financial performance, coupled with possibilities from AI integration that continues to drive emotions. Once these factors are revived, the conversation will increasingly return to the potential for long-term value of the stock.

Using that strength to look at bookings as we explore new high-tech frontiers, the real question is whether this sets the stage for purchasing opportunities or is the market already considering future growth?

Most Popular Stories: 10.8% Underrated

The current consensus narrative position reserves holdings as undervalued compared to its calculated fair value, and optimism is driven by strong operational execution and future-looking growth initiatives.

Reservation Holdings incorporates AI technology throughout its platform to improve operations, streamline traveler experiences and strengthen supplier partnerships. This is expected to drive future revenue growth and improved margins. The focus on increasing alternative accommodation and expanding the genius loyalty programme is aimed at enhancing customer retention, capturing a wider market and potentially boosting revenue and net profits.

Want to know which growth makes this rating appealing? Secret recipes include ambitious financial forecasts, bold margin targets, and a set of future multiples that the tech sector will blink. The real surprise is that the story bets on the profitability curve that indicates the holding of reservations. Are you interested in promoting this optimism? The numbers behind it may challenge everything you thought you knew about travel inventory.

Results: Fair value of $6,100.36 (undervalued)

Read the story in full and understand what lies behind the predictions.

However, changing global travel demand or rising customer acquisition costs can quickly challenge these optimistic forecasts and restructure expectations for booking holdings.

Find out about the important risks to this Reservation Holdings story.

Another view: Multiple Approach

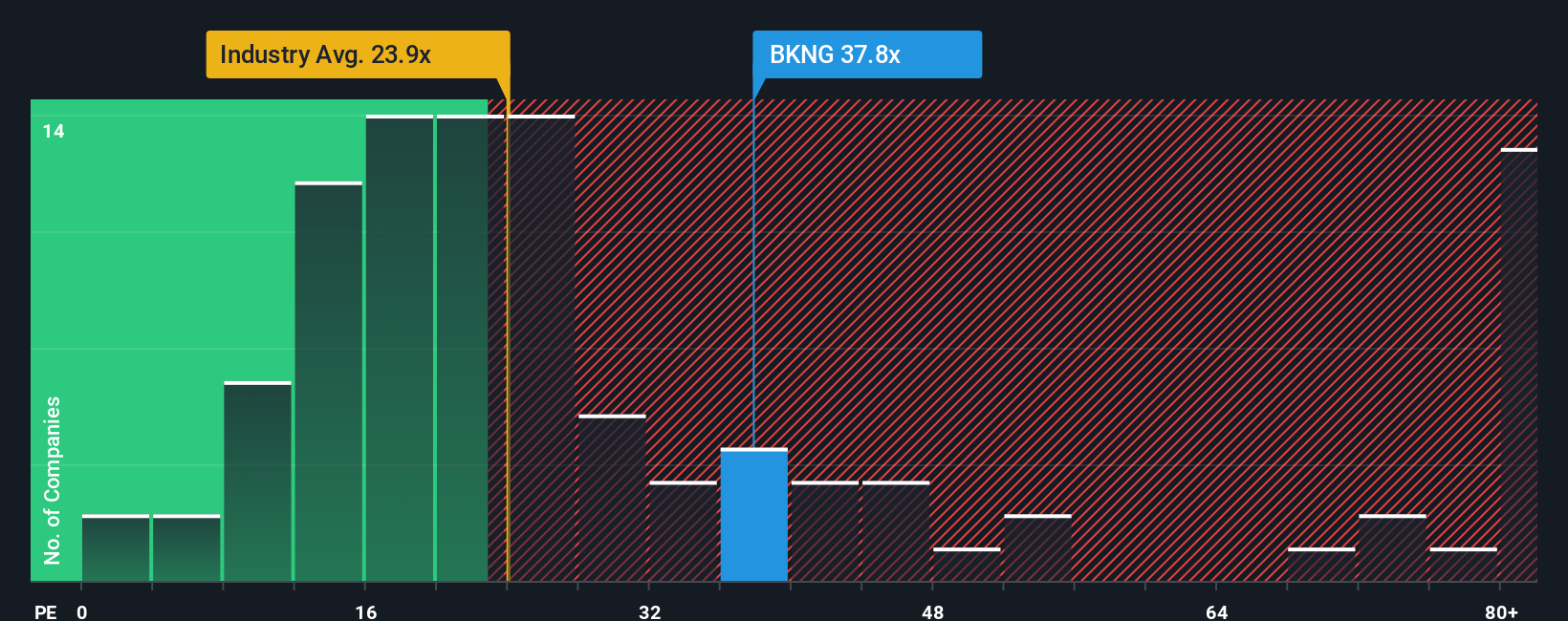

Looking at the different lenses, current market prices appear to be higher compared to their US hospitality sector peers using revenue-based multiples. Does this approach miss out on the elements that justify premiums or should we be careful?

See what the numbers say about this price. Find out our ratings breakdown.

It will be updated if you add a reservation holding to your watchlist or portfolio and the valuation signal shifts. Or explore the screeners and discover other companies that meet your criteria.

Build your own reservation holdings story

If you're not convinced by the general outlook, or if you want to dig into the details yourself, you can build a personalized story in minutes. Do it your way.

A great starting point for Reservation Holdings research is an analysis that highlights two important rewards and one important warning sign that could affect your investment decision.

Looking for more investment ideas?

A smart investor never settles on one opportunity. With these handpicked stock ideas already being watched by millions, expand your watchlist and seize overlooked winners. Don't let the next breakout pass you.

- Budget-friendly stocks will acquire unparalleled growth by leveraging penny stocks in strong finances that often hide tomorrow's giants in today's small cap.

- It is a spotlight company that secures income, builds wealth with dividend stocks with yields above 3%, and offers yields above 3% against robust and reliable returns.

- Riding the wave of technology with quantum computing stocks, tracking innovators at the forefront of quantum computing, forming the next chapter of high-performance technology.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

The evaluation is complicated, but we're here to simplify it.

Discover whether reservation retention is underestimated or overestimated in our detailed analysis; Fair value estimates, potential risks, dividends, insider trading, and its financial position.

Access Free Analytics

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email editorial-team@simplywallst.com