Broadcom's custom AI accelerators are gaining momentum.

nvidia (NVDA) 0.34%)) He is the king of indisputable artificial intelligence (AI) investments. Its products have been used from the start to train and run AI models and are still the computing unit of choice for many AI hyperscalers.

However, there are more competitors beginning to gain a lot of traction with these giants. it's not AMD (NASDAQ:AMD)because its product is very similar to Nvidia's products. Broadcom (avgo) -0.05%)) He is a rising player in this field and does that with custom chips designed to collaborate with end users. This could create a different business model than Nvidia currently uses, potentially challenging Nvidia's AI hegemony in the coming years.

Image source: Getty Images.

Broadcom's custom design allows you to replace NVIDIA GPUs in some applications

Nvidia manufactures graphics processing units (GPUs). It is perfect for any task that requires critical computing power. A GPU can process multiple calculations in parallel. This is an effect that can be amplified when hundreds or thousands are connected in a computing cluster. GPUs are also used for gaming graphics, engineering simulation, drug discovery and mining cryptocurrency, making them useful for many non-artificial intelligence workloads. For a variety of use cases, GPUs are designed to provide flexibility for deployed applications.

Nvidia's GPUs are the number one choice, as Nvidia's GPUs are best in class and AI Hyperscalers don't spare the cost to enable the best AI models. But what if these GPUs only show one type of workload during service lifetime? Second, all the extra features that give you flexibility for workloads that do not use GPUs will no longer be useful. From there, Broadcom's custom AI accelerator will be released.

Broadcom works with end users to design chips that meet your needs, so you can't buy many NVIDIA GPUs. These application-specific chips are not as flexible as GPUs, and are actually one-trick pony. But that one trick allows you to outweigh the GPU, as you don't have to pay for additional features. What's more, Broadcom works with end users rather than selling the full product, so customers don't have to pay massive premiums like Nvidia chips.

This will lead to large market opportunities and enable Broadcom to challenge Nvidia's dominance in the long term. But what benefits can investors expect?

Broadcom shares received premium from the market

The market is well aware of the growing power of Broadcom. The stock has risen nearly 10% after new customers in XPU (what they call custom AI accelerators) revealed they placed $10 billion orders in the quarter. This has grown by more than 50% this year, which continues to have an incredible stock of Lambalecom.

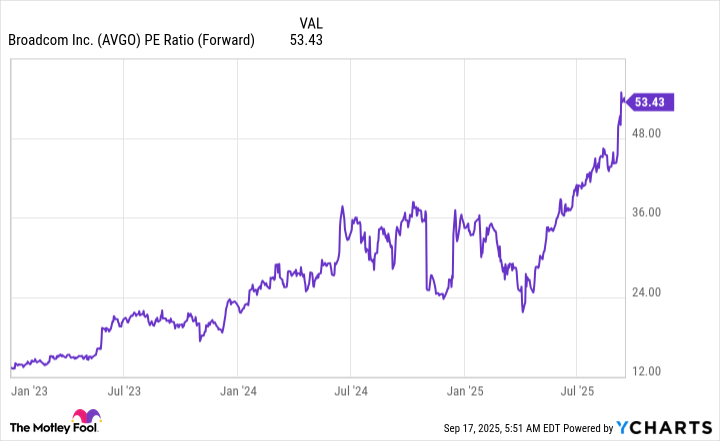

However, due to all the excitement surrounding Broadcom's growing AI business, the stock is beginning to get expensive. Broadcom is currently trading 53 times more advanced revenues. This is much more expensive than the peer Nvidia.

AVGO PE ratio (forward) data from YCHARTS

However, that premium is guaranteed. Broadcom's AI revenue rose 63% year-on-year to $5.2 billion in the third quarter of fiscal year 2025 (ends August 3). This was faster than Nvidia's second quarter in fiscal year 2026 (ends July 27), with revenues increasing 56% to $46.7 billion.

It should be noted that this is a significant revenue total discrepancy and that Broadcom does more than just a custom AI accelerator. Within the AI department there is a data center networking witch that is used regardless of whether a custom AI accelerator is deployed or whether the client is using an NVIDIA GPU. Additionally, Broadcom has many other business units, which has slowed overall growth. Companywide in the third quarter, Broadcom revenues rose 22% year-on-year to $16 billion.

So, Broadcom still has a way to go before becoming the next Nvidia. But I think 2026 could be an incredible year for the company, as its custom AI accelerator has gained momentum. In anticipation of this rise, the stock has already won one tonne. Now it's up to Broadcom to provide the hype it created around itself. I don't think investors need to sell NVIDIA stocks yet, but they should keep an eye on Nvidia's AI growth to understand how each one operates.

Kizen Drury holds positions for Broadcom and nvidia. Motley Fool features advanced microdevice and Nvidia, and is recommended. Motley Fool recommends Broadcom. Motley Fools have a disclosure policy.