- Earlier this month, Artificial Intelligence Underwriting Company (AIUC) announced that UiPath has become a founding technical contributor to AIUC-1, the leading enterprise security framework for AI agent deployment based on global standards and third-party audits.

- UiPath’s involvement highlights UiPath’s commitment to strengthening AI security and compliance for organizations that use autonomous agent technology in critical workflows.

- Here’s a look at how UiPath’s new leadership role in AI enterprise security could impact the investment story going forward.

AI is changing healthcare. These 30 stocks address everything from early diagnosis to drug discovery. The best part is that these companies have market capitalizations of less than $10 billion. There’s still time to get in early.

UiPath investment story summary

To become a UiPath shareholder, it’s important to believe in the company’s ability to leverage enterprise automation and AI security, backed by deep partnerships and robust compliance standards. While UiPath’s recent announcement of its role as a founding technology contributor to the AIUC-1 Enterprise Security Framework demonstrates a commitment to trusted AI adoption, it is unlikely to materially alter the immediate revenue impact of challenges posed by corporate transaction delays and macroeconomic uncertainty in the near term.

Among UiPath’s recent announcements, a multifaceted collaboration with NVIDIA stands out regarding the AIUC-1 news. Both are focused on driving secure and efficient AI-driven automation in business-critical areas, either through joint technology frameworks or through applied AI in sensitive areas, and highlight how UiPath is positioning its platform as a key enabler of secure and compliant workflow automation as the adoption of autonomous agents accelerates.

However, in contrast, investors should be aware of how continued geopolitical delays in the completion of corporate transactions are impacting…

Read the full story on UiPath (it’s free!)

UiPath forecasts revenue of $1.9 billion and revenue of $243.6 million by 2028. This forecast assumes annual revenue growth of 8.6%, with revenue increasing by $311.1 million from current levels of -$67.5 million.

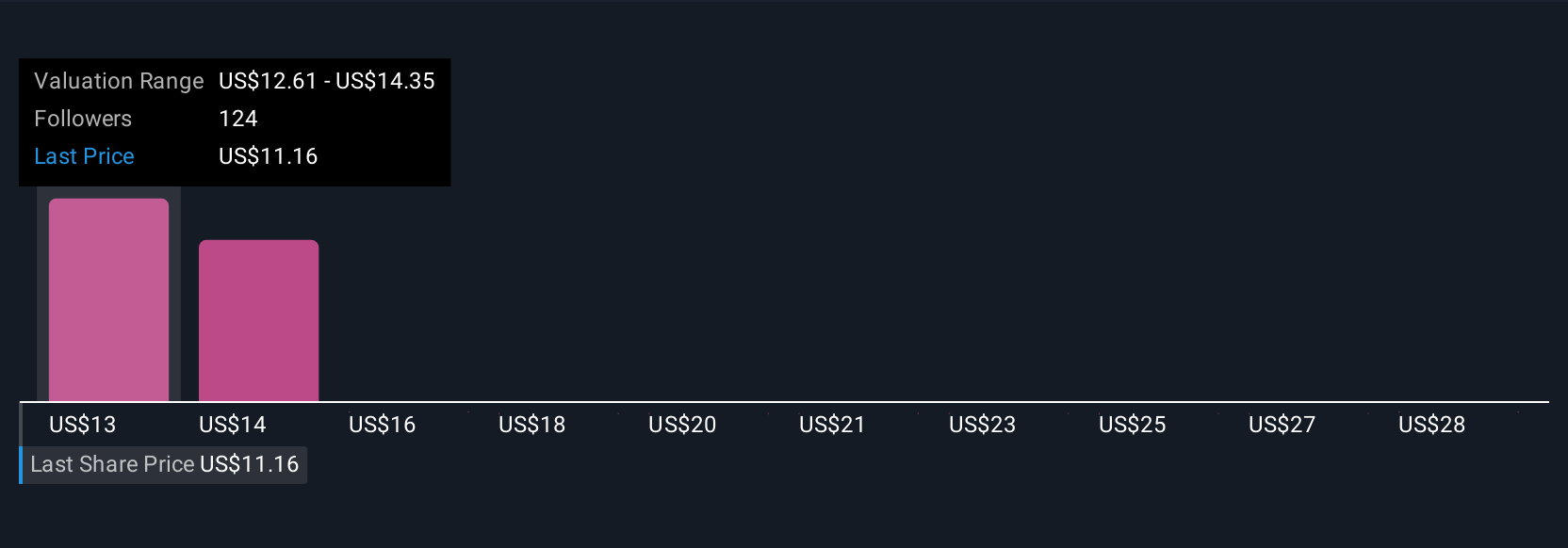

We reveal how UiPath’s forecast matches the current price to create a fair value of $13.86.

explore other perspectives

Simply Wall St Community shares 13 fair value estimates for UiPath, ranging from US$13.70 to US$30.00, indicating significant differences in outlook. Your view of the company’s ability to overcome delays in the completion of corporate transactions may be a key factor in shaping its performance in the coming months, so consider many perspectives and decide what is most important to you.

Explore 13 other fair value estimates on UiPath – Find out why the stock is worth more than twice its current price.

Build your own UiPath narrative

Don’t agree with an existing story? Create your own in under 3 minutes. Following the herd rarely yields exceptional investment returns.

Ready for a different approach?

The market won’t wait. These fast-moving stocks are in the spotlight right now. Get the list before running.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

new: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend powerhouse (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email editorial-team@simplywallst.com.