- Earlier this month, Flex Ltd. took part in a highly-profile technology conference hosted by JPMorgan and Goldman Sachs, announced a new five-year warrant agreement with Amazon and submitted a prospectus supplement to the SEC.

- The combination of sector-wide AI enthusiasm and analyst commentary highlighting Flex's role in AI-related manufacturing solutions focuses on investor long-term outlook and industry relevance.

- Here we update the optimism in the AI sector and explore how Amazon Warrant contracts form Flex's long-term investment outlook.

AI is trying to change healthcare. These 31 strains work on everything from early diagnosis to drug discovery. The best part – they're all under $10 billion in market capitalization – there's still time to get in early.

Flex Investment story summary

Being a Flex shareholder requires confidence in the company's ability to maintain its key role as a leading manufacturer of cloud, data centers and senior electronic clients, especially as demand for AI infrastructure increases. While this month's well-known meeting and Amazon partnership will strengthen Flex's positioning, customer concentration risk remains the biggest short-term concern, while the main short-term catalyst remains the AI fuel demand for data center solutions. The latest news may be positive about emotions, but the risks of client inhalation remain material.

In a recent announcement, Flex's five-year warrant agreement with Amazon stands out as directly related. It highlights a deep relationship with one of Flex's biggest customers, and while it may support trust in future revenue streams for Flex's role in the production of AI hardware, it does not completely resolve concerns about customer dependency.

In contrast, investors need to know how even a single major hyperschool drive for more in-house production can be done…

Read the complete story of Flex (free!)

Flex's Outlook revenue is expected to be $29.1 billion, with a profit of $1.3 billion by 2028.

It reveals how Flex forecasts generate a fair value of $57.86 in line with current prices.

Explore other perspectives

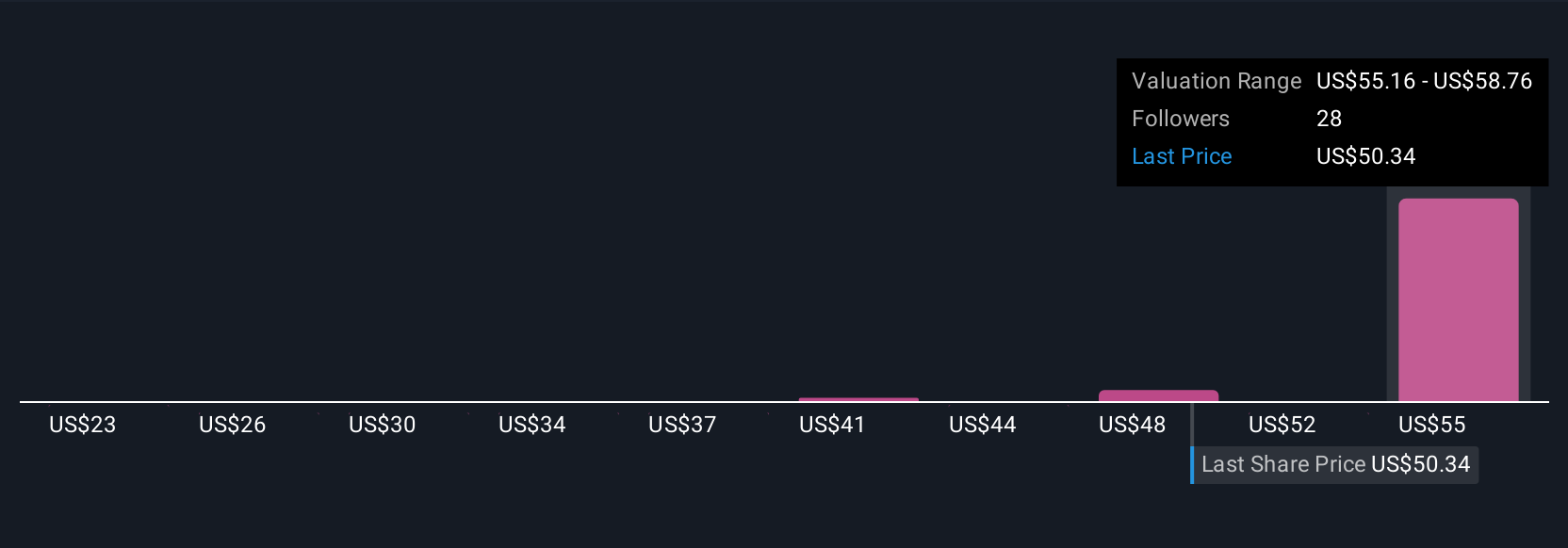

Seven estimates from the Simply Wall St Community show fair value targets of USD 22.73 to USD 64 per share. Despite Flex's industry positioning, the continued customer focus risk can shape performance in a very different way that experts and retail investors see.

Explore 7 other fair value estimates for Flex – why stocks are 12% higher than current prices!

Build your own flex story

Do you oppose existing stories? Create your own creation within 3 minutes – extraordinary investment returns rarely come from following the flock.

- A great starting point for Flex Research is an analysis that highlights three important rewards and one important warning sign.

- The free Flex Research report offers a comprehensive basic analysis, summarized in a single visual (snowflake).

Ready to try other investment styles?

Our top stock discoveries are now flying for radar. Get in early:

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

new: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to reveal opportunities.

•Dividend Powerhouse (yield of 3% or more)

Underrated small cap with insider purchases

High-growth technology and AI companies

Or create your own from over 50 metrics.

Explore now for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email editorial-team@simplywallst.com