Tell your AI assistant to “plan a trip to Miami”, then sit in the back as you're finding the perfect flight, hotel and buying the new fishing reel you've been hoping for. This is the vision behind Visa's Intelligent Commerce. This is a new platform that allows you to find, shop and buy AI's “agent” software. At Visa's recent Product Drop 2025 event, CEO Ryan McInerney and Chief Product Officer Jack Offertell announced the initiative as “a new way to buy with AI using the same reliable and secure payment methods.” It is a big visa bet on agent commerce, where autonomous AI agents handle the entire shopping trip for consumers. the goal? To close the “Discovery-Purchase” gap, once AI finds the perfect item, you can actually check out and pay seamlessly with all the fraud protection and trust in the visa network.

Tell your AI assistant to “plan a trip to Miami”, then sit in the back as you're finding the perfect flight, hotel and buying the new fishing reel you've been hoping for. This is the vision behind Visa's Intelligent Commerce. This is a new platform that allows you to find, shop and buy AI's “agent” software. At Visa's recent Product Drop 2025 event, CEO Ryan McInerney and Chief Product Officer Jack Offertell announced the initiative as “a new way to buy with AI using the same reliable and secure payment methods.” It is a big visa bet on agent commerce, where autonomous AI agents handle the entire shopping trip for consumers. the goal? To close the “Discovery-Purchase” gap, once AI finds the perfect item, you can actually check out and pay seamlessly with all the fraud protection and trust in the visa network.

One thing that's for sure is that Commerce UX is evolving. A few years later, we recall spending hours comparing – shopping and filling out forms, AI Butler handles the mundane purchases in the background. And Visa quietly executes registers on all these machines (intermediated transactions) (preferably reduced) cuts, but gets much more volume.

Is the same visa in the New World? Not accurate, but Visa does what a savvy incumbent does. And in 2025, that pack is an autonomous agent who is eager to buy things for us. Get ready – your next customer may not be human, and now is the time to plan it.

This deep dive will analyze where you are, including what Visa Intelligent Commerce has to offer, why it's important for FinTech and Payments Ecosystem, and how it intersects the programmable money and crypto world of Web3. Let's dig deeper.

Visa's Intelligent Commerce

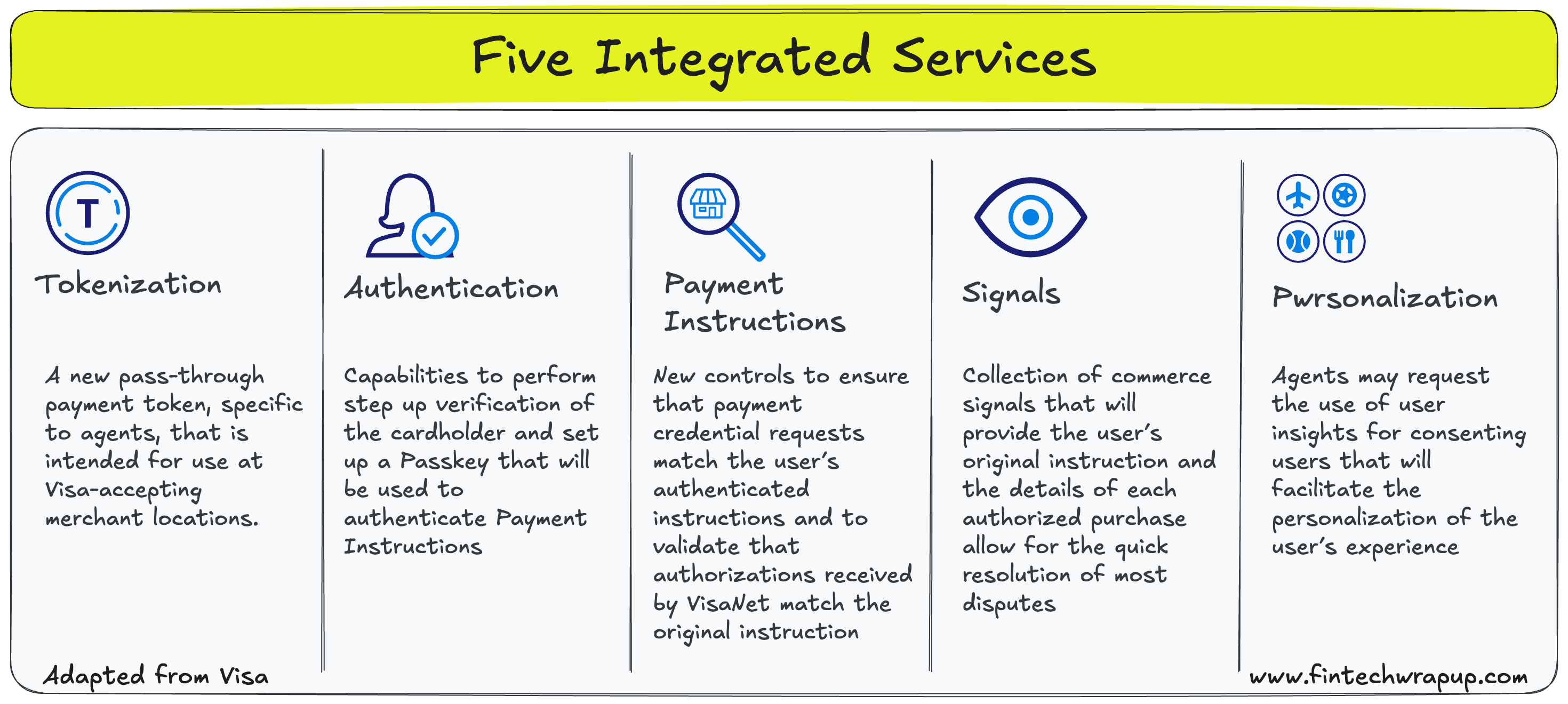

Visa's Intelligent Commerce initiative is essentially a developer platform and partner program that enables purchasing to drive AI. It introduces a suite of five APIs spanning tokenization, authentication, personalized data, payment instructions and payment signals, designed to enable AI agents to trade as securely and smoothly as human shoppers. Visa has also announced an agent onboarding framework (through its partner program) that validates and authenticates AI agents before leveraging the network. And they didn't let it go alone – Visa lined up key partnerships with AI and FinTech's big names to jump this ecosystem. They are working with OpenAI to set standards for agent commerce and enable use cases on OpenAI's platform. They are working with Stripe (the major payment processor already experimenting with agents) to adopt Visa's solution and drive agent-based payments. Perplexity AI, a fast and growing AI search platform, integrates Visa's personalization API to further customize your shopping recommendations. RAMP, known for its business finance, is considering use cases for V2B agents on a visa. Scale AI partners on the infrastructure side to support Enterprise-Grade Agent Commerce. In short, Visa brings together both AI innovators and traditional payment players to build an “agent commerce” network backed by Visa's trust.

So, what do these new APIs actually do?

Visa has discussed five core services that provide AI agents with the same functionality as human users using additional GuardRails in E-Commerce. Here's a simple summary –

-

AI – Ready Cards – Visa is upgrading Trued Tokenization and User Authentication Tech (digital payment “workhall”) in the age of agents. Tokenization means that 16 digit card numbers are replaced by unique digital tokens. In this case, Visa will issue a token specific to the AI agent when the bank confirms that you are “you.” That token is bound to your agent and is locked by default – it is active for purchase only if you (human) grant your agent permission. On the other hand, strong authentication (such as Visa Secure, 3-D Secure, Biometrics) is built in so when you first “onboard” your card to an agent, the bank will confirm that you are truly you and authorize that agent to be enabled. Essentially, the AI Assistant will get its own visa card token that can be used, but only with explicit consent, it will use its trustworthy agent platform.

-

Personalization (Data Token) – One of the great benefits of AI shopping is that you can know your preferences. Visa has a service called Data Tokens that gain insight from your purchase history (preferred brands, preferred hotels, dining preferences, etc.) and gain insight from maintaining the “insights” that agents can use. Importantly, Visa emphasizes continuing to manage your data. You must opt-in and agree to these personalization tokens and can be turned off at any time. Data tokens do not publish raw transaction history. They are similar to tips that AI can plug in to prompts to improve recommendations (“users prefer boutique hotels over budget options”). In the demo, agents' travel suggestions were quickly improved as users switched personalizations. Beach hotels (they don't like them) and more sushi restaurants and activities that suit your actual interests. Takeaway – Visa is injecting a wealth of transactional data into AI logic – with user permission, guiding agents, making shopping feel creepy (and saving you from endless, unrelated search results).

-

Payment Procedures – This is an all-new API visa built to act as a “digital handshake” between users and agents. When the agent is ready to buy something, he will present a summary of the items, prices, merchants, etc. and asks them to go ahead. Visa's payment procedure API records the exact purchase parameters you have approved (WHO/WHAT/WHET for that transaction) and stores them as a signature record. Think of it as an agent's permission slip. It proves that the AI has permission to make that particular purchase. This instruction is essentially the user's intent and is officially captured. It later guarantees there will be controversy (“Hey, did my AI just buy the wrong flight?”), and there is an authoritative log of what you actually agreed to. It also limits what agents can spend your money on. This is a clever way to prevent runaway bots from buying 100 TVs with cards. Visa is essentially formalised. “Yes, my users said it's okay to buy.

These items under These conditions. ” -

Payment Signals – Finally, when an agent actually charges a card token at the merchant's checkout, Visa's payment signal API is generated. Just before payment, the agent sends Visa a “purchase signal” describing the pending transactions (merchant, amount, etc.). Visa's system matches previously approved saved payment instructions. If everything is lined up correctly, Visa unlocks the tokens for that one transaction and advances the payment to the seller. If something doesn't match (for example, the price or merchant is different), the agent will not obtain permission to claim. This payment signal step also provides a wealth of context with banks, merchants and more, helps to share transaction-fraud checks, properly post transaction details, and share purchase services. Essentially, it links all the parties' dots – publishers and merchants see it

this The transaction is initiated by a trusted agent and is compliant with the user's instructions, so it is much more likely that it will be approved and not contested. As a result, there is less decreasing of falsehood, less fraud, “Who made this purchase?” Agent confusion – Driven transactions.

In summary, these components form a complete agent-commer pipeline. When you buy something using an AI agent, run one time setup to safely add your visa card to your agent (via tap or scan), authenticate with the bank, set limits or settings. Visa then provides the token, from that point on, the agent is “Payment-valid”. From now on, the flow – asks the agent for something → the agent finds it → the agent asks for permission to purchase From the user's perspective, it is a simple confirmation that follows the conversation.

Behind the scenes? Many heavy lifting by Visa's API gives you a sense of magic.

Disclaimer:

FinTech collects information that is only available through information provision. Some of the content can be recreated verbatim from the original source, with full credits being “Source: [Name]”Attribute. All copyrights and trademarks remain the property of their respective owners. FinTech summary does not guarantee the accuracy, completeness or reliability of the aggregated content. These are the responsibility of the original source provider. Links to the original source may not always be included.