If you're a Salesforce (CRM) watcher, the latest news may be sitting straight at your desk. The company took a bold step with the AI front, expanding its Agent Force and data cloud platform, building a marquee partnership with CrowdStrike to ensure AI-driven workflows, and increasing its UK investment with a $6 billion commitment. These moves suggest a clear ambition to lead the evolving corporate AI landscape, a sector that has become more important by the month for large organizations around the world.

With strong quarterly results, investors' sentiment has generally become positive. Salesforce shares have pulled back around 11% over the past three months and remained a 26% decline per year, but the long-term photos show that the company has returned more than 71% over the past three years. This suggests that the momentum has cooled a bit in the short term, despite the new AI-driven revenue stream gaining traction and contract bookings continuing to rise.

After this year's revision, will Salesforce offer attractive entry points for long-term investors, or is the market expecting more growth than it can already offer?

Most Popular Stories: 8.7% Overrated

According to the latest extensive paper by Goran_damchevski, the general narrative suggests that Salesforce appears to be trading above fair value. A detailed analysis of the story highlights several catalysts that could affect future assessments, but argues that current expectations may exceed what they can realistically offer over the next few years.

The company has improved its profitability margin, with operating margin rising 2.8% to 20%, and net profit at 16.1%, up 24% year-on-year at 13%. The company is gradually increasing its profitability, upgrading its estimates from 17.5% in 2028 to 20% in 2029.

What's behind these bold numbers? This story leaps against a few strong assumptions, including expanding future margins, ambitious revenue targets, and valuations that are normally reserved for market leaders. Are you interested in which single financial bets move the Salesforce intrinsic value dial? Don't miss out on how these forecasts reveal the calculations behind the stock price.

Results: Fair value of $223.99 (overvalued)

Read the story in full and understand what lies behind the predictions.

However, unexpected company wins and success in attracting small business customers could quickly change momentum courtesy of Salesforce, despite current concerns.

Find out about the key risks to this Salesforce story.

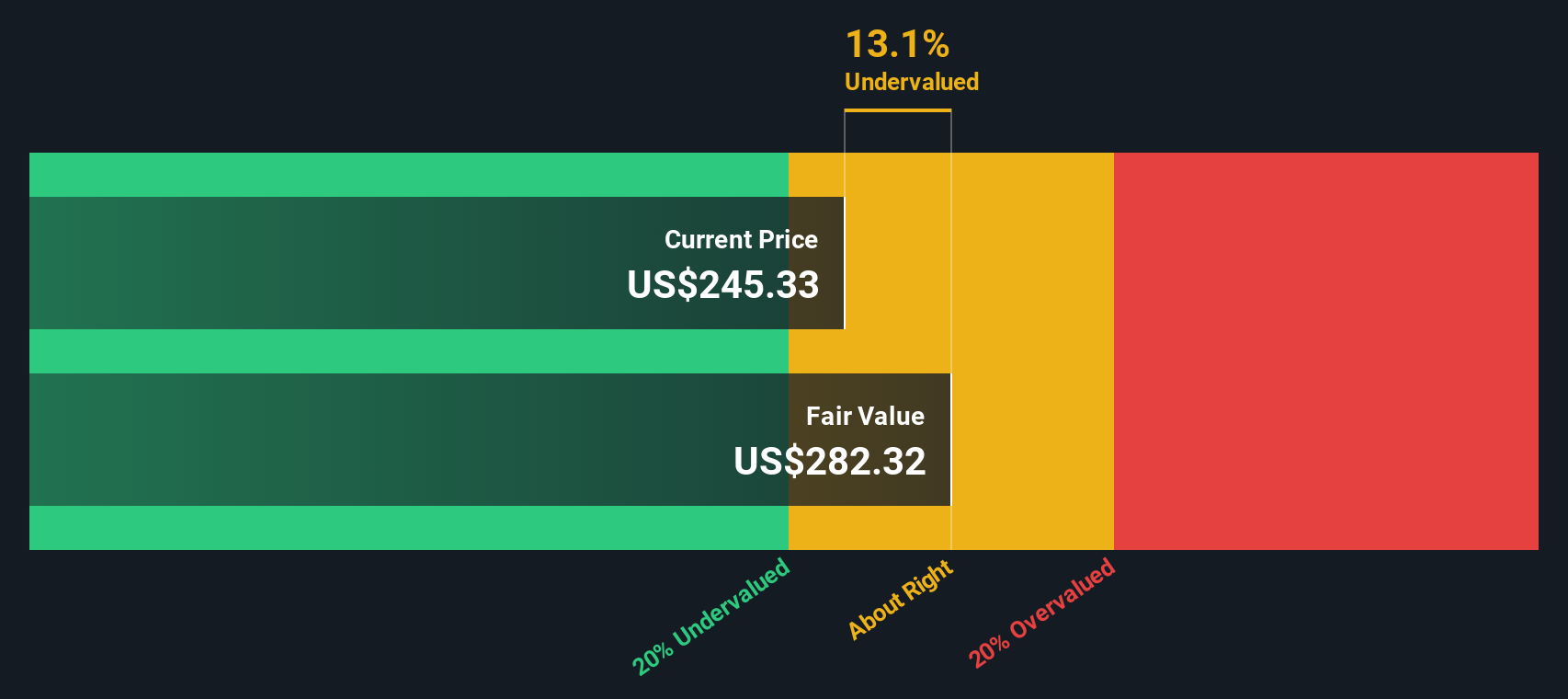

Another view: Discounted cash flow says it's undervalued

A step back from valuation based on multiples of revenue, the SWS DCF model reaches another conclusion. This approach points to Salesforce transactions that are below estimated fair value. Is there something missing from the market here?

Find out how the SWS DCF model reaches fair value.

If you add Salesforce to your watchlist or portfolio, it will be updated if the valuation signal shifts. Or explore the screeners and discover other companies that meet your criteria.

Build your own Salesforce story

If things look different, or if you want to dig into numbers directly, you can create a personalized view of your Salesforce story in just minutes. Do it your way.

A good starting point is that the analysis highlighting the four key rewards is that investors are optimistic about Salesforce.

Looking for more investment ideas?

Don't pass you the next great opportunity. Use the power of the Simply Wall Street screener to find the winner of tomorrow beyond Salesforce.

- Using cryptocurrencies and blockchain stocks, we leverage traditional financial shaking companies by following the latest trends in digital currencies.

- We uncover robust income opportunities by examining companies known for reliably delivering dividend stocks to shareholders at a yield of 3% or more each year.

- Innovations that transform the target game in healthcare by exploring companies that leverage artificial intelligence for smarter patient solutions in healthcare AI stocks.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

new: Manage all your inventory portfolios in one place

I've created it The ultimate portfolio companion For stock investors, And it's free.

Connect unlimited number of portfolios and check totals in one currency

•Announce new warning signs or risks via email or mobile

•Track the fair value of your inventory

Try our demo portfolio for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email editorial-team@simplywallst.com