If you're focusing on your portfolio PayPal Holdings (PYPL), you may have noticed the latest news sitting there. PayPal has announced a multi-year strategic partnership with Google, aiming to knit AI shopping experiences across the platform and expand payment processing integration. The two companies position the collaboration as a leap in digital commerce, with PayPal's trustworthy payment infrastructure enhancing more seamless transactions and Google's AI capabilities to enhance consumer and business personalization.

The announcement comes as PayPal is gaining momentum using new peer-to-peer payment tools and initiatives to increase user engagement, such as PayPal links and global wallet interoperability. While the rollout of these products shows that it focuses on innovation, stock prices talk about something else. PayPal stocks have fallen about 21% so far this year, sliding 11% over the past 12 months, reflecting the ongoing skepticism of market skepticism. Despite the short-term rebounds and promising signals in customer recruitment, momentum has not yet caused a long-term shift.

With this fresh partnership and the surge in launches of PayPal products, are investors staring at potential value plays, or are the market already burning with the company's future growth prospects?

Most Popular Stories: 35% Underrated

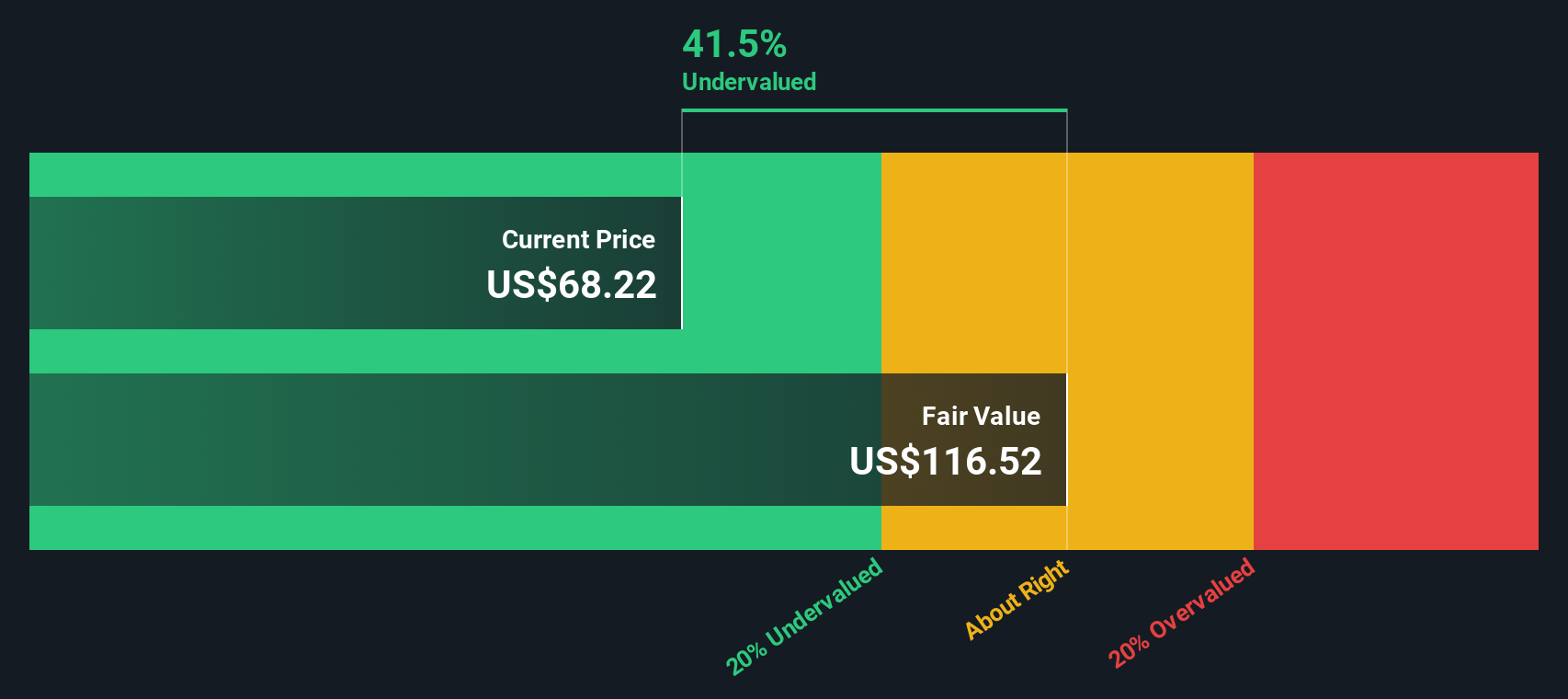

According to ZWFIS, the general narrative considers PayPal to be significantly undervalued, and its fair value is estimated to be much higher than its current market price.

Venmo is a very popular app and tool that people use all over the place. One of the problems with previous management was how to monetize it. Slowly, in addition to earning interest from transaction fees and unused cash from customers, they began adding debits and credit cards to the mix. Plus, and what I'm most optimistic about is how they allow them to use the benmo in their stores. For example, the other day when I was using Doordash I realized that Venmo was an option to use for payments. They have already begun to spread a very simple process into the merchant business. I think this will bring in a lot of revenue while increasing profit margins.

Want a glimpse into the numbers fueling this bold underestimation call? The big story lies on ambitious profit growth, clever platform expansion, and potential future benefits. Are you interested in how some very specific growth levers can drive major rises? This is one calculation you don't want to miss.

Results: Fair value of $105.25 (undervalued)

Read the story in full and understand what lies behind the predictions.

However, sustained competition with other fintech providers and the risk of slowing expected user growth could challenge PayPal's optimistic outlook for the future.

Find out about the key risks to this PayPal Holdings story.

Another view: DCF ratings enhance underestimation

The SWS DCF model closely examines PayPal's future cash flows and reaches the same conclusion as the initial approach, indicating that the stock is undervalued at its current price. Does this add support to the case or is it emphasizing what the subjective predictions will look like?

Find out how the SWS DCF model reaches fair value.

Simply Wall St performs discounted cash flows (DCFs) on every stock around the world every day (check PayPal Holdings, for example). This complete description of the entire calculation. You can track your results in a watchlist or portfolio and alert you when this changes, or use a stock screener to discover undervalued stocks based on cash flow. When you save a screener, you may even warn you when a new company matches. So you won't miss out on potential opportunities.

Build your own PayPal Holdings story

If these perspectives do not match your own perfectly, you can look directly through the data and shape your own story in just a few minutes.

A good starting point is that the analysis highlighting the five key rewards is that investors are optimistic about PayPal Holdings.

Looking for more opportunities than you deserve your attention?

Expand your horizons and gain the edge by exploring other powerful competitors that may suit your goals and investment style. There are powerful ideas you shouldn't simply overlook.

- Ensure income potential and stable profits when you browse companies offering impressive yields through us Dividend stocks with yields of 3% or more.

- Get the momentum of groundbreaking innovation by checking out companies at the forefront of AI technology ai penny stock.

- With our help, leverage value by targeting stocks with healthy foundations that may be below their intrinsic value Undervalued stocks based on cash flow.

This article simply by Wall Street is inherently common. We provide commentary based on historical data and analyst forecasts, and use impartial methodologies, and our articles are not intended for financial advice. It is not a recommendation to buy or sell stocks and does not take into account your goals or financial situation. We aim to deliver long-term intensive analysis driven by basic data. Please note that the analysis may not take into account the latest price-sensitive company announcements and qualitative material. Simply put, the Wall ST has no position in the stock mentioned.

new: Manage all your inventory portfolios in one place

I've created it The ultimate portfolio companion For stock investors, And it's free.

Connect unlimited number of portfolios and check totals in one currency

•Announce new warning signs or risks via email or mobile

•Track the fair value of your inventory

Try our demo portfolio for free

Do you have feedback in this article? Are you worried about the content? Please contact us directly. Alternatively, please email editorial-team@simplywallst.com