Nvidia may grab most of the headlines, but another tech company is quietly building its own AI empire.

It's no secret that artificial intelligence (AI) has been a major theme driving Wall Street movements in recent years. Specifically, the level of demand for high-performance GPUs, networking equipment, and data centers has been a big part of the AI story to date.

But what about monetization? Which companies to value — other than that? Nvidia (NVDA +0.11%) — Creating real, measurable growth with AI can be difficult.

In my opinion, investors focused on AI; meta platform (meta 0.51%) While its mega-cap peers are getting the most attention, the social media leader could be on its way to becoming the next big contributor to AI.

Image source: Getty Images.

Meta's AI revenue puts competitors at a disadvantage

Meta owns and operates four large social media platforms: Facebook, Messenger, Instagram, and WhatsApp. The company serves an average of 3.5 billion daily active users across its “family of apps.” So it's no wonder advertisers are eager to reach Meta's huge audience.

During the third quarter, Meta had revenue of $51.2 billion, of which $50 billion came from its advertising division. This represents a 26% year-over-year growth. While this was impressive, it wasn't enough to get Wall Street excited.

What's interesting is how Meta maintains its growth profile. Within its AI division, Meta has introduced a product called Advantage+, a suite of machine learning tools to help advertisers improve targeted campaigns.

During the company's third-quarter earnings call, CFO Susan Lee told investors that Advantage+ currently generates $60 billion in annual revenue. This was nearly a threefold increase compared to the first quarter.

Beth Kindig, principal technology analyst at I/O Fund, drew an interesting parallel between Meta's growth and OpenAI's. ChatGPT was made publicly available nearly three years ago in November 2022. According to numerous media outlets, OpenAI is expected to achieve a revenue run rate of $20 billion in 2025. Over the same period, Meta grew its AI advertising business from virtually nothing to $60 billion, three times the size of OpenAI.

Taking this a step further, Kindig writes, “We need to increase our growth rate from 175% to 460% year over year.” microsoft To match Meta's AI revenue. ”

Against this backdrop, Kindig claims that Meta has quietly become the second-largest AI monetizer after Nvidia.

Today's changes

(-0.51%) $-3.40

current price

$662.55

Key data points

Market capitalization

$1.7 trillion

daily range

$660.75 -$665.00

52 week range

$479.80 -$796.25

volume

4.1M

average volume

18M

gross profit

82.00%

dividend yield

0.32%

Cash flow in 2026 may be modest

While Kindig's analysis is interesting, investors shouldn't get too hung up on the hierarchy of AI-related sales. A more important takeaway from her analysis is that Meta's sales growth appears to be slowing compared to the accelerating sales growth of emerging AI products.

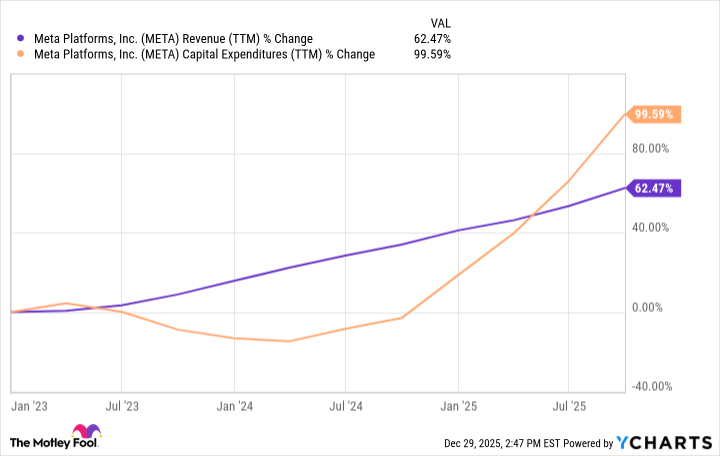

META Revenue (TTM) data by YCharts.

As I mentioned earlier, most of the talk surrounding AI over the past few years has been about spending. Perhaps no company has come under more scrutiny in this regard than Meta.

Capital investment is far outpacing revenue growth. In the long term, this is unsustainable.

No wonder investors were spooked when Meta's management team said capital spending in 2026 would be “significantly larger.” The combination of aggressive spending and new revenue streams that are not yet mature will almost certainly hamper Meta's ability to generate excess cash flow in 2026.

Is Meta stock a good place to buy now?

I agree with Kindig in the sense that most investors are probably overlooking the scale and potential of Meta's new AI advertising business, but smart investors aren't going to jump into a stock based on a single metric.

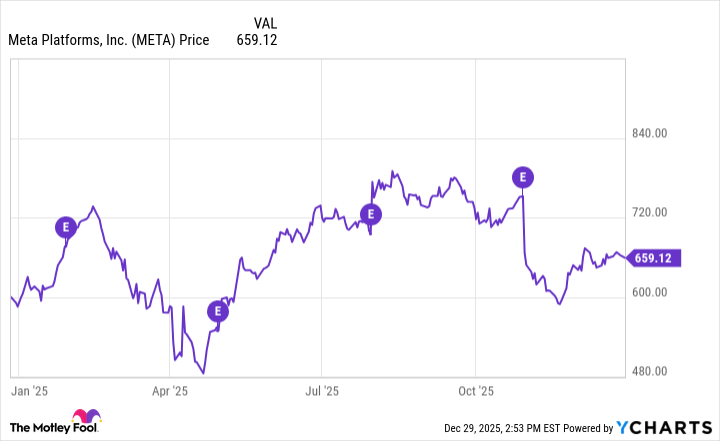

META data by YCharts.

Over the last year, Meta's stock has gone through a number of peaks and troughs. The notable decline in stock prices was largely due to investors' wariness about the company's spending.

Given past performance and Advantage+'s trajectory, I'm personally cautiously optimistic about its prospects. However, there is still much to prove Amazon, alphabet,others.

For these reasons, smart investors should keep an eye out for specific updates on Advantage+ and Meta's other AI ambitions. If these products continue to blossom and the company grows faster than its current spending trajectory over the long term, I would take advantage of the selling pressure and buy on the New Year's bullshit.